Introduction

hello friends, meet me again Tuyanto this time I will provide information about the arrival of a very extraordinary company, because this company is a decentralized digital asset lending platform through blockchain technology and deFi.

Decentralized Finance or DeFI is currently the prima donna in today's blockchain world. DeFi has a vision and goal to transform today's financial sector by providing decentralized financial services by leveraging blockchain technology and smart contracts.

The need for decentralization of financial services is important because currently the central authority controls all functions in this sector. Bitcoin and blockchain emerged with the main function of eliminating the role of third party institutions by directly authorizing users to participate in crypto trading, many who thought their applications were limited to payments or money transfers, but the financial sector or decentralized DeFi also exploded. And for more details, you can directly contact this website: https://rain.credit/ or you can directly cooperate with a very extraordinary project below.

About the Rain.Credit Project?

Rain.Credit

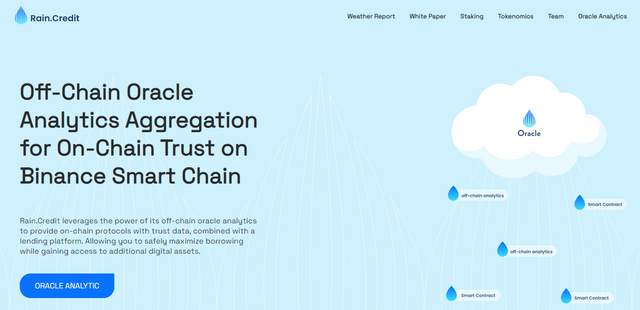

Rain.Credit is a BEP20 token on the Binance Smart Chain which acts as a non-custodial Off-Chain Data analytics Oracle Aggregator providing concise Credit rating on a user’s address. This credit rating is used to provide a better collateral factor for digital asset lenders and borrowers on the rain platform. Rain.Credit is based on the current decentralized lending platforms and protocols, but with various changes to bring an even more innovative design and experience.

Rain.Credit Featurs:

- Off-Chain Oracle Analytics

- Digital Trust

- Non Custodial Lending

- Credit Score

- Trust Network

- Binance smart chain / ethereum compatible

How Rain drops works

RAIN = Amount to borrow + Transaction History / Amount to secure

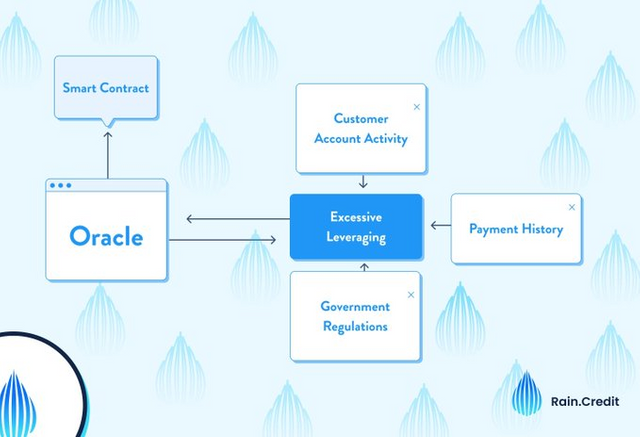

Oracles provide a solution to the transparency issue many defi projects face. By taking off chain information and supplying the data in an immutable way, the Rain.Credit Oracle enables smart contracts to pull data from from blocks that contain the needed information. The information transmitted by the Rain.Credit oracle will include things that can’t be tracked or monitored by the blockchain. This includes user payment history across multiple chains, real world economic events, changing government policies and user account history.

Borrow More Assets With Less Collateral

Rain Loans is a non-custodial digital asset lending and borrowing platform. It is based on the compound protocol with altered asset pools and the use of Rain+ to increase access to extra funds on top of the current collateralized debt positions (CDP) offered by Compound Finance, AAVE & CREAM.

Rain+ is an additional amount of tokens which we offer to borrowers through our platform without supplying any extra collateral, based on their transaction history and rating from Rain Off-Chain oracle analytics.

Tokenomics

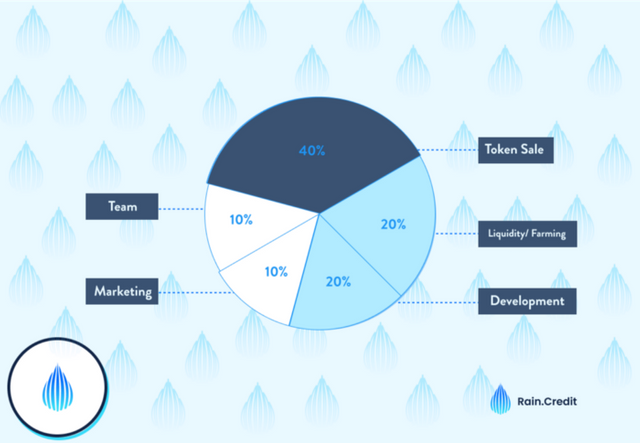

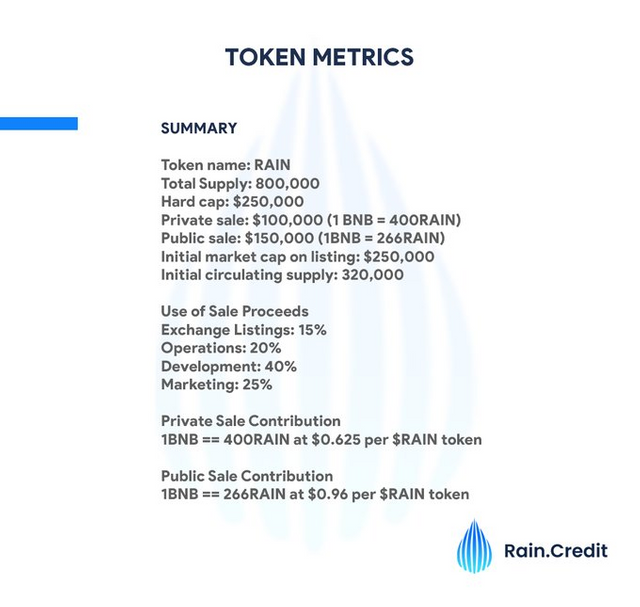

$RAIN has a simple distribution model. It’s total supply consists of 800,000 $RAIN.

The token distribution is as follows:

- 40%: will be sold via presale

- 20%: will be used for project development

- 20%: will be used to provide Liquidity and yield farming

- 10%: tokens will be allocated to the team (For 2 years, these tokens will be locked to instill confidence in the community)

- 10%: will be used for marketing

Rain.Credit Roadmap

Q2–2021 (Testnet Season)

Our focus for the second quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform working effectively on the testnet within a short period of time. We also aim to further build on the Oracle platform by building the “Trust Network”, which motivates data providers.

- $RAIN token Presale (read more)

- Exchange Listings

- Testnet Off-Chain Aggregation Oracle Analytics

- Testnet Lending Platform.

- Testnet Trust Network

- Deflationary Staking and Farming Launch

Q3–2021 (Mainnet Season)

Our focus for the early third quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform migrated from Testnet to Mainnet within a short period of time. We also aim to further build on the Oracle platform by launching the “Trust Network”, which incentives data providers.

- Contract Audits Lending and Oracle

- Mainnet Off-Chain Oracle Analytics

- Mainnet Lending Platform

- Aggregated Data Providers

- Trust Network

- RAIN Oracle Hackathon

Q4–2021 (Middleware Season)

This quarter will be heavily focused on middle-ware integration and an exciting period for our community with the RAIN drops Governance DAO launch.

- Oracle Network Release 2.0 (Beyond Aggregation Analytics)

- Off-Chain Oracle Marketplace Release supporting multiple chain

- RAIN GraphQL Abstraction Layer Launch

- RAIN Governance DAO

- Off-Chain Asset Management and Monitoring Platform Release

- Off-Chain Asset Management and Monitoring Platform Release (One-Click Integration with non-blockchain based platform)

- Comprehensive API and Documentation Release

Q1–2022 (Cross-Chain Season)

First Quarter will see a focus on Cross-Chain integration beyond the Ethereum network with a view to make our services available across multiple blockchain networks.

- Cross-Chain Collateral Lending

- Cross-Chain Oracle Launch

- Smart Contract Analytics Platform

- Cross Chain Trust Score (Beyond Ethereum Network)

- Asset Group Trust Score

- Continuous development and improvement of the Trust Network

- Academic research and publication of Trust Score impact in the DeFi sector

Rain.Credit Team

Rainbuilder / Lead Developer

Hail / Developer

Drizzle / Community Manager

Monsoon / UI/UX Designer

Conclusion

Rain.Credit is taking the opportunity to create a more trustworthy ecosystem while also providing an incentive to participate in borrowing and lending to increase a user’s Credit score. Off-Chain analysis utilization to build trust in lending and borrowing in the defi space is something that has not been explored before loans are processed. With the ability to use real life information and events as a factor in decision making, users can worry less about credibility, trustworthiness, higher collateral factor and focus on using their assets to help grow their portfolios while participating in an innovative and trailblazing platform.

For more information Connect to the Rain Project. Credits:

- Website: https://rain.credit/

- Telegram: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

- Github: https://github.com/orgs/Rain-Credit

- Medium: https://rain-credit.medium.com/

- Twitter: https://twitter.com/rain_credit

- Discord: https://discord.gg/aEc7NWbU

Tidak ada komentar:

Posting Komentar