What is Rabbit Finance?

Rabbit Finance is a leverage growth protocol powered by Binance Smart Chain. This allows farmers to generate higher profits by opening a leveraged position.

Rabbit Finance is a leveraged crop growing protocol based on Binance Smart Chain (BSC) published by Rabbit Finance Lab. It supports users involved in growing liquidity through excessive lending and leverage to generate more profit.

When a user does not have enough funds, but wants to participate in growing Defi's liquidity, Rabbit Finance can provide up to 10X leverage to help users get the maximum return per unit of time, while at the same time providing a pool of borrowing for users who prefer stable income. to make a profit.

What is RABBIT Token?

The RABBIT token is the governance token of the Rabbit Finance platform. It will also allow for economic benefits from the platform. Maximum 200 million RABBIT tokens.

What is the RABBIT token for?

Protocol control

soon launch a management repository that will allow community members to stake their RABBIT tokens. The RABBIT staker will receive an xRABBIT, where 1 xRABBIT = 1 vote, allowing them to make decisions on key management decisions. Initially, management decisions will be based on Snapshot.

Get economic benefits from the platform

Rabbit Finance Protocol users (depositors and borrowers, i.e. lenders and farmers) will be rewarded with a RABBIT token for their deposit and loan actions. The Rabbit Finance platform will create a buyback fund from its income that will be used to deflation and boost the value of the RABBIT token. When profits are reinvested, 30% of this amount is used to fund the RABBIT buyback fund. 20% of the depositor's interest income is used as a market development fund. All of this will help increase the demand and value of RABBIT.

Obtaining economic benefits from RUSD, RBTC, RBNB

The RABBIT token is a shareholder rights token of the stablecoin algorithm RUSD, RBTC, RBNB, etc. Whenever RUSD, etc. is inflationary, participants who pass the RABBIT token to the boardroom will share the additional RUSD as dividends to share the benefits of green growth. ... For more details, please take a look at our subsequent announcement.

Strengths and vision

Rabbit Finance fully leverages and adopts the benefits of projects in the market, leverages crop products with excess leverage with the benefits of Alpaca Finance and Badger Finance, creatively combines the algorithm's stablecoin mechanism to empower the RABBIT token. In the entire economic ecology of Rabbit Finance, the RABBIT token, endowed with a large number of application scenarios, represents not only the rights to manage and interests of the leveraged yield farm protocol, but also the token of the rights and interests of shareholders of the stablecoin of the RUSD algorithm. Whenever RUSD is inflationary, members who donate R tokens to the boardroom will share the additional RUSD as dividends to share the benefits of green growth.

Rabbit Finance believes the leveraged crop growing platform will be the next killer app in the Defi space after the decentralized exchange and lending platform. The stablecoin algorithm is also believed to be the last Holy Grail in the Defi domain. They were and will be the most important infrastructure in the Defi world.

Rabbit Finance's vision is to become the Federal Reserve System of the Defi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and efficient financial services at an affordable cost to people of all walks of life and groups in need of financial services. Rabbit Finance is not a simple leveraged crop growing platform or algorithmic stablecoin system. It will be a decentralized and inclusive financial services infrastructure with the possibility of continuous hematopoiesis, based on blockchain technology. Compared to the same role as the Fed, what Rabbit Finance expects goes far beyond the Fed's role in the global economy.

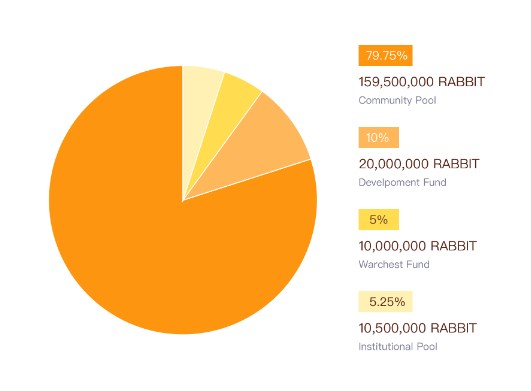

RABBIT Distribution

Public swimming pool

79.75% of the total supply , about 159.5 million RABBITS.

RABBIT will be released over two years with a shrinking emission schedule and will be evenly distributed across the ecosystem as a community reward.

Institutional pool

5.25% of the total supply , 10.5 million RABBIT

Provide a 5.25% investment quota for established organizations and investors. Upon completion of the investment, 245,000 RABBITs will be issued every 7 days, and 10,500,000 RABBITs will be issued within 300 days (about 10 months). The exact time will be determined, please note the following announcement.

Hard cap : 10,500,000 RABBIT = 525,000 USDT

Exchange rate: 1 RABBIT = 0.05 USDT

Development Fund

5% of the total supply , about 10,000,000 RABBITS.

5% of distributed tokens are reserved for future strategic spending. In the first month, 250,000 tokens were issued for listing fees, auditing, third-party services, and partner liquidity.

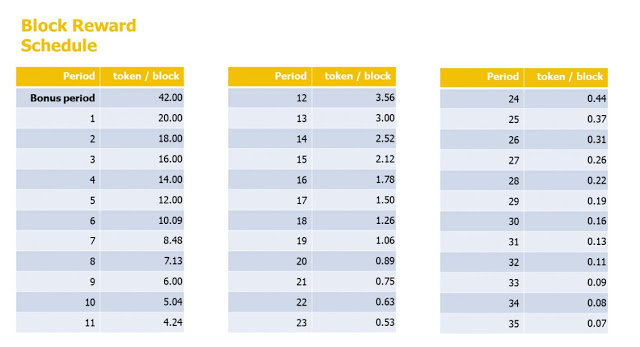

Public Pool Release Program

The RABBIT token will be released over a two-year period with a shrinking emission schedule and will be evenly distributed throughout the ecosystem as a community reward.

There will be 159.5 million RABBITS in total. In order to incentivize first users, a bonus period will be in effect in the first weeks. Below is our planned block reward schedule. On its basis, you can build a profile of the circulating supply RABBIT.

For more information follow the links below:

- Rabbit Finance website: http://rabbitfinance.io/

- Github: https://github.com/RabbitFinanceProtocol

- Twitter: https://twitter.com/FinanceRabbit

- Telegram: https://t.me/RabbitFinanceEN

- Discord: https://discord.gg/tWdtmzXS

- Contract information: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

- Audit report: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

Tidak ada komentar:

Posting Komentar